- Trade Policies

- Currency Fluctuations

- Economic Stimulus

Trade Policies

U.S. presidential elections have a profound impact on trade policies, both domestically and internationally. The trade policies of the United States influence global economic dynamics, as the country is one of the largest economies in the world. This analysis delves into how presidential elections in the U.S. shape trade policies, the implications for global trade, and the economic and geopolitical consequences of these changes.

Historical Context

Trade Policies Across Different Administrations

U.S. trade policies have varied significantly across different presidential administrations. For instance, Republican administrations have traditionally favored free trade, while Democratic administrations have sometimes prioritized labor and environmental standards in trade agreements.

- Reagan Administration (1981-1989): Promoted free trade, reduced tariffs, and supported the General Agreement on Tariffs and Trade (GATT).

- Clinton Administration (1993-2001): Advanced globalization with the North American Free Trade Agreement (NAFTA) but also incorporated labor and environmental considerations.

- Trump Administration (2017-2021): Took a protectionist stance, renegotiated NAFTA into the USMCA, and imposed tariffs on China, sparking trade tensions.

Impact of Presidential Elections on Trade Policies

Shifts in Trade Agreements

U.S. presidential elections often lead to shifts in trade agreements. Candidates’ positions on trade influence their approach to existing agreements and the negotiation of new ones.

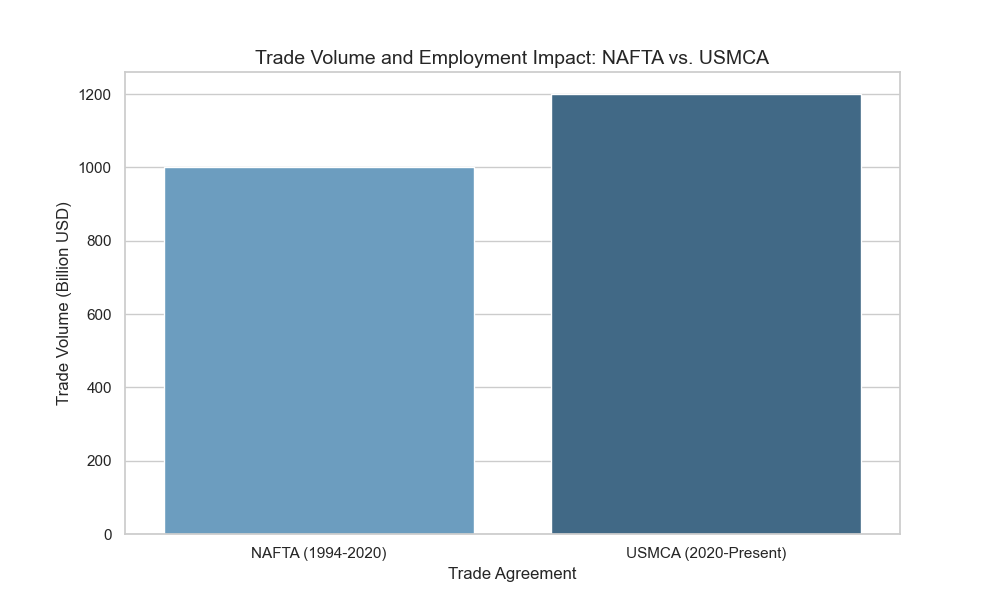

- NAFTA to USMCA: The transition from the Obama to Trump administration led to a renegotiation of NAFTA. Trump’s campaign criticized NAFTA, leading to the USMCA, which included new provisions on labor rights and intellectual property.

- Paris Agreement and Trade: The 2016 election saw the U.S. withdrawing from the Paris Climate Accord under Trump, which had indirect effects on trade policies, especially in sectors like energy and manufacturing. The Biden administration reversed this decision, impacting trade relations related to climate policies.

Tariffs and Trade Wars

Elections can also result in the imposition or removal of tariffs, which are a critical component of trade policy.

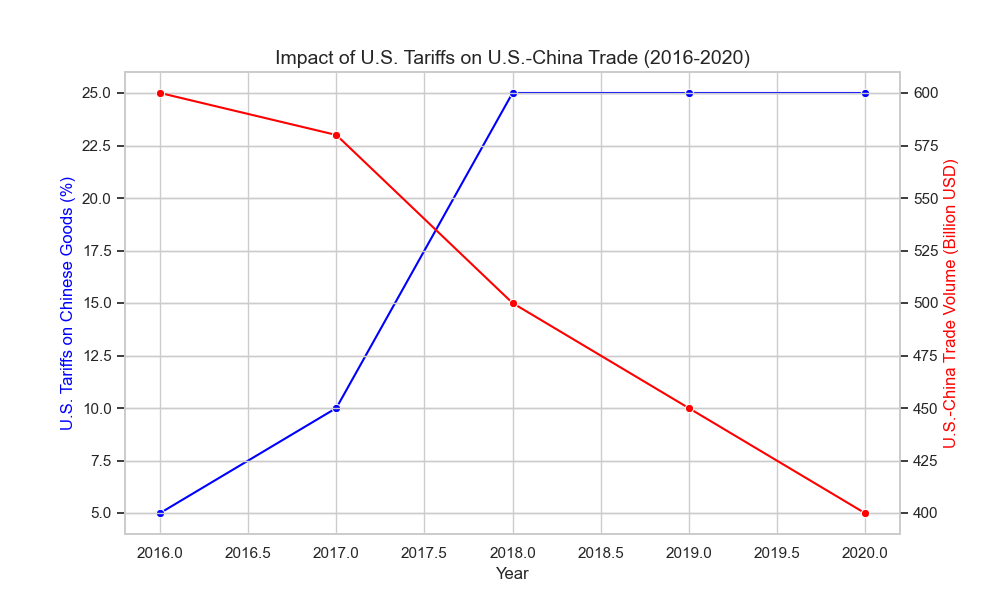

- Trump’s Tariffs on China: The 2016 election led to the imposition of tariffs on Chinese goods, aiming to reduce the trade deficit and address intellectual property theft. These tariffs affected global supply chains and led to retaliatory tariffs from China.

- Biden’s Trade Approach: The Biden administration has maintained some of the tariffs but has focused on rebuilding alliances and working through multilateral institutions like the World Trade Organization (WTO).

Regulatory Changes

Presidential elections can lead to regulatory changes that affect trade. For instance, a president with a focus on environmental issues may implement regulations that impact industries like coal or steel, affecting trade in those sectors.

Economic and Geopolitical Consequences

Global Economic Impact

The trade policies enacted following U.S. presidential elections can have significant effects on the global economy. For example, the tariffs imposed by the Trump administration disrupted global supply chains, leading to increased costs for businesses and consumers worldwide.

Geopolitical Implications

Trade policies are also a tool of geopolitics. U.S. presidential elections can alter the country’s relationship with major powers like China and the European Union. For instance, the trade war initiated under Trump led to a realignment of trade alliances, with China seeking to strengthen ties with other countries through initiatives like the Belt and Road Initiative.

Case Studies

Trump vs. Biden on Trade with China

The 2020 election provided a clear contrast in trade policies between the two candidates. Trump’s approach was more unilateral and confrontational, while Biden advocated for working with allies to address trade issues with China.

Obama’s TPP vs. Trump’s Withdrawal

The Obama administration promoted the Trans-Pacific Partnership (TPP), a trade agreement that aimed to strengthen economic ties between the U.S. and Asia-Pacific nations. However, Trump withdrew from the TPP, leading to concerns about U.S. influence in the region and allowing China to expand its economic presence.

Conclusion

U.S. presidential elections have a profound impact on trade policies, shaping the global economic landscape and influencing international relations. The policies enacted by each administration can lead to significant changes in trade agreements, tariffs, and regulatory frameworks. Understanding these impacts is crucial for businesses, policymakers, and global leaders as they navigate the complexities of international trade.

References

-

World Trade Organization (WTO). “World Trade Report 2021.” WTO, 2021. Available at: WTO World Trade Report 2021

-

International Monetary Fund (IMF). “Global Trade and U.S. Trade Policy.” IMF, September 2020. Available at: IMF Global Trade and U.S. Trade Policy

-

Council on Foreign Relations (CFR). “The U.S.-China Trade War: A Timeline.” CFR, March 2021. Available at: CFR U.S.-China Trade War: A Timeline

-

Brookings Institution. “The Impact of the USMCA on North American Trade.” Brookings, January 2020. Available at: Brookings Impact of the USMCA on North American Trade

-

Harvard Business Review (HBR). “How U.S. Presidential Elections Influence Global Trade.” HBR, October 2020. Available at: HBR How U.S. Presidential Elections Influence Global Trade

Currency Fluctuations

U.S. presidential elections have a significant impact on the financial markets, including the foreign exchange (Forex) market. The anticipation of policy changes, economic strategies, and geopolitical shifts that may arise from a new administration can lead to substantial currency fluctuations. This analysis explores how U.S. presidential elections influence currency values, particularly the U.S. dollar (USD), and examines the mechanisms through which these effects manifest.

Historical Overview

Election Uncertainty and Currency Volatility

Currency markets are highly sensitive to uncertainty, and presidential elections are a major source of such uncertainty. Historical data shows that in the months leading up to an election, the U.S. dollar often experiences increased volatility. This volatility can be attributed to investor speculation about the potential outcomes of the election and the subsequent impact on economic policies.

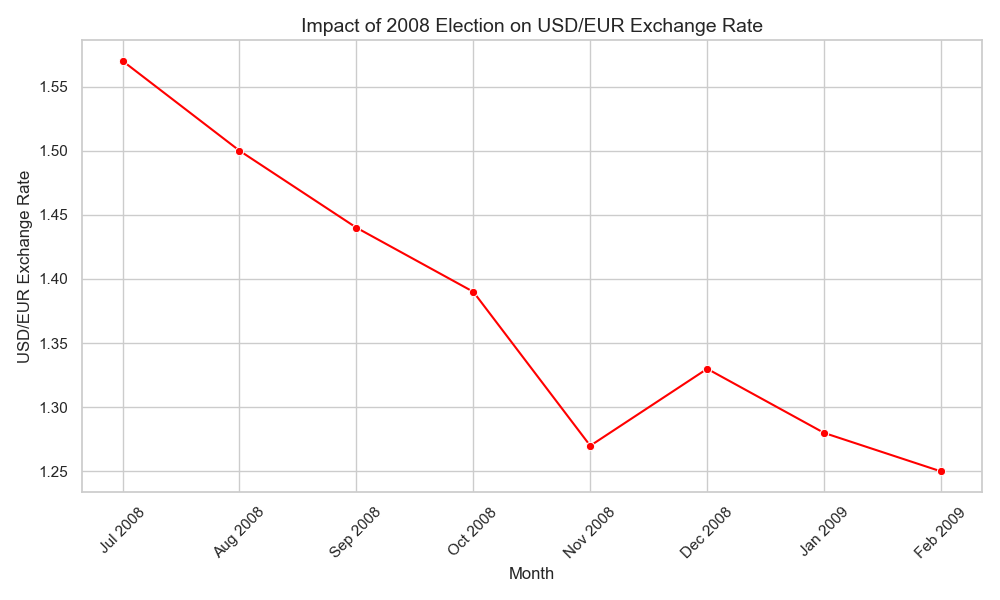

- 2008 Election: During the financial crisis, the 2008 election saw significant fluctuations in the USD as markets reacted to the potential economic policies of the candidates.

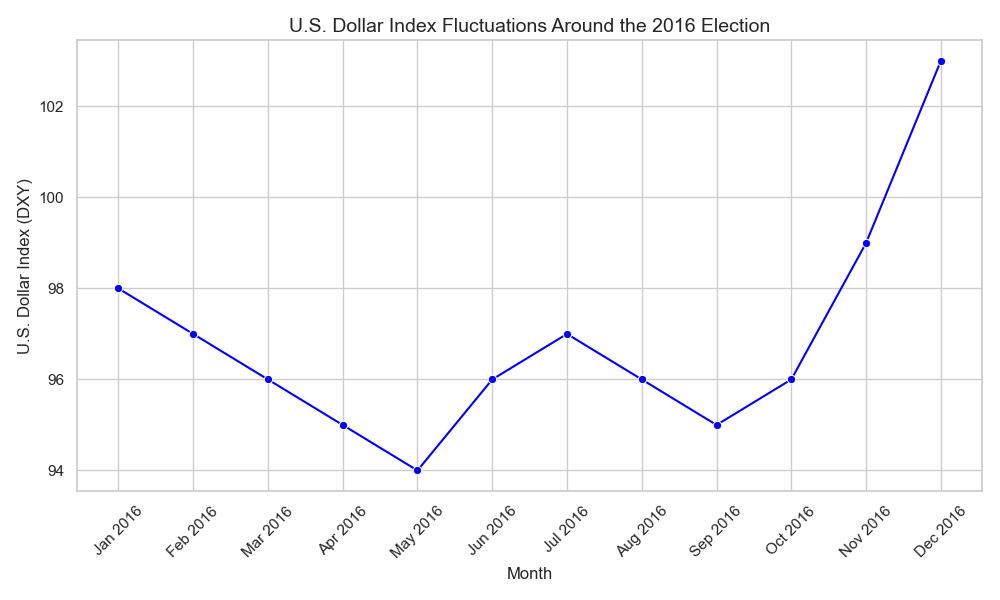

- 2016 Election: The surprise victory of Donald Trump led to a sharp increase in the value of the USD, as markets anticipated deregulation, tax cuts, and a focus on domestic growth.

Post-Election Currency Movements

The period following an election can also see dramatic currency movements, depending on the policies that the new administration promises to implement. Markets quickly adjust to the perceived economic direction, whether it be through fiscal stimulus, trade policies, or monetary policy changes.

Factors Influencing Currency Fluctuations During Elections

Economic Policy Expectations

One of the primary drivers of currency fluctuations during elections is the market’s expectations regarding future economic policy. Key areas of focus include:

- Fiscal Policy: Changes in government spending and taxation can influence the strength of the USD. For example, expansive fiscal policies might lead to a stronger dollar due to expectations of higher economic growth.

- Monetary Policy: Presidential candidates’ views on the Federal Reserve’s independence and monetary policy can also impact the dollar. A candidate favoring lower interest rates might weaken the USD.

Trade Policies

Trade policy is another critical factor, especially given the global interconnectedness of the U.S. economy. Markets react to a candidate’s stance on trade agreements, tariffs, and international relations, all of which can influence the USD.

- Trump’s Trade Policies: The 2016 election led to expectations of more protectionist trade policies, which initially strengthened the USD as investors anticipated reduced trade deficits but later contributed to volatility as trade wars began.

Geopolitical Risks

The global influence of the U.S. means that presidential elections can have significant geopolitical implications. Candidates’ foreign policies, military strategies, and diplomatic approaches can lead to fluctuations in the USD as investors adjust their risk perceptions.

Case Studies of U.S. Presidential Elections and Currency Fluctuations

2008 Election: Obama vs. McCain

The 2008 election occurred during the global financial crisis. Barack Obama’s victory was followed by a period of relative dollar weakness as markets anticipated expansive fiscal policies and an accommodative monetary stance to combat the recession.

2016 Election: Trump vs. Clinton

Donald Trump’s unexpected victory in 2016 caused immediate volatility in global markets. Initially, the USD strengthened significantly due to expectations of tax reforms, deregulation, and infrastructure spending. However, the dollar experienced increased volatility in the following years due to trade tensions and unpredictable foreign policies.

Economic and Market Implications

Investment Flows

Currency fluctuations during and after presidential elections can significantly impact investment flows. A stronger USD might attract foreign investment into U.S. assets, while a weaker dollar could lead to capital outflows as investors seek higher returns elsewhere.

Inflation and Interest Rates

Currency movements directly impact inflation. A stronger dollar makes imports cheaper, which can help contain inflation, while a weaker dollar can increase import costs, potentially leading to higher inflation. The Federal Reserve may adjust interest rates in response to these inflationary pressures, further influencing currency values.

Conclusion

U.S. presidential elections are a critical driver of currency fluctuations, with the potential to cause significant volatility in the Forex market. Understanding the factors that influence these movements, such as economic policy expectations, trade policies, and geopolitical risks, is crucial for investors and policymakers alike. Historical examples from the 2008 and 2016 elections illustrate how market sentiment and expectations can lead to substantial changes in the value of the USD, with far-reaching implications for the global economy.

References

- Federal Reserve Bank of St. Louis. “U.S. Dollar Index (DXY).” Available at: St. Louis Fed U.S. Dollar Index

- International Monetary Fund (IMF). “The Impact of Political Uncertainty on the Currency Market.” IMF, 2020. Available at: IMF Political Uncertainty and Currency Market

- Bloomberg. “How U.S. Elections Influence Currency Markets.” Bloomberg, 2020. Available at: Bloomberg U.S. Elections and Currency Markets

- Harvard Business Review (HBR). “Political Risk and Currency Markets.” HBR, October 2020. Available at: HBR Political Risk and Currency Markets

Economic Stimulus

U.S. presidential elections significantly influence the direction of economic policy, particularly concerning economic stimulus measures. Economic stimulus refers to policy actions aimed at boosting economic activity, often through government spending, tax cuts, or monetary interventions. The strategies surrounding economic stimulus are crucial during times of economic downturns or crises, and presidential elections often determine the approach the government will take.

Historical Overview of Economic Stimulus in the U.S.

Great Depression and New Deal (1930s)

The election of Franklin D. Roosevelt in 1932 marked a significant shift in economic policy, with the introduction of the New Deal. This extensive series of economic programs was designed to provide relief, recovery, and reform in response to the Great Depression. The New Deal set a precedent for large-scale government intervention in the economy during times of crisis.

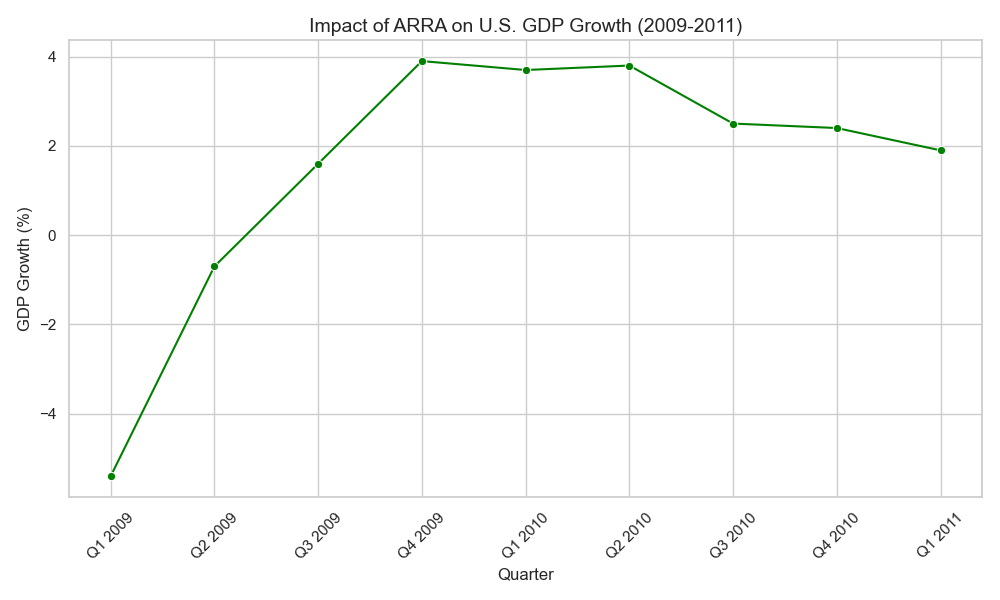

2008 Financial Crisis and the American Recovery and Reinvestment Act (ARRA)

The 2008 presidential election, held in the midst of the global financial crisis, led to the election of Barack Obama. His administration enacted the ARRA in 2009, a stimulus package worth $787 billion aimed at mitigating the effects of the recession. The package included tax cuts, unemployment benefits, and funding for infrastructure projects.

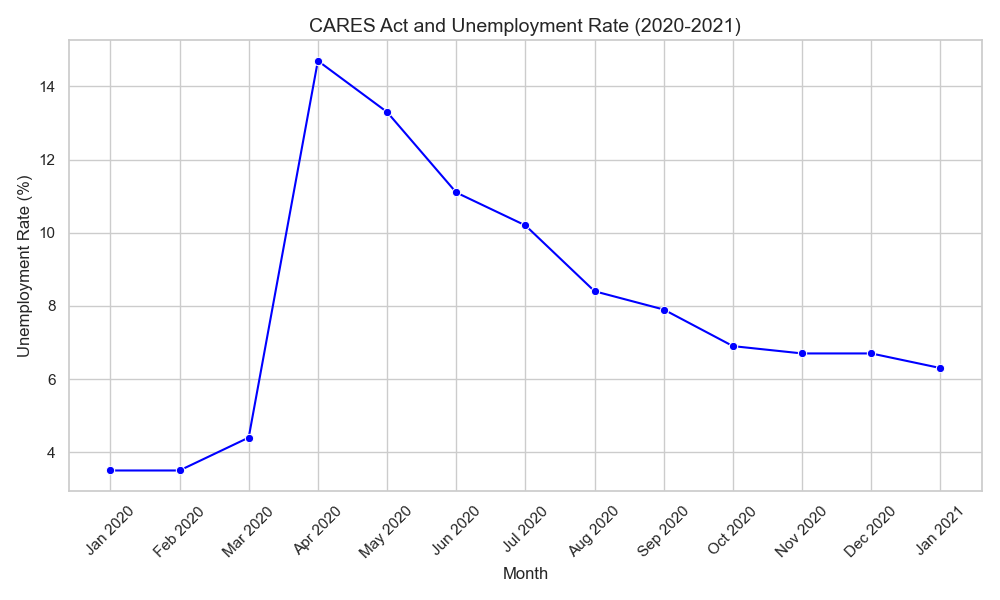

2020 COVID-19 Pandemic and the CARES Act

The COVID-19 pandemic, which coincided with the 2020 presidential election, prompted unprecedented economic stimulus measures. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law in March 2020, provided over $2 trillion in economic relief. This included direct payments to individuals, expanded unemployment benefits, and loans to businesses.

Influence of Presidential Elections on Economic Stimulus Decisions

Policy Differences Between Parties

U.S. presidential elections often highlight significant differences between the Democratic and Republican parties regarding economic stimulus. Democrats typically favor more direct government intervention and spending, while Republicans often advocate for tax cuts and limited government spending.

-

Democrats: Generally, Democrats support larger stimulus packages focused on social programs, infrastructure, and direct financial assistance to individuals. This approach is based on Keynesian economics, which argues that increased government spending can help stimulate demand during economic downturns.

-

Republicans: Republicans tend to prioritize tax cuts as a means of stimulating economic activity, underpinned by supply-side economic theories. These policies are designed to increase disposable income for businesses and individuals, encouraging investment and consumption.

Campaign Promises and Market Reactions

During presidential campaigns, candidates often outline their approaches to economic stimulus. The financial markets react to these proposals, with investors making decisions based on anticipated fiscal policies.

-

2016 Election: Donald Trump’s campaign promises of tax cuts and deregulation were well-received by financial markets, leading to a post-election rally in stocks, often referred to as the “Trump bump.”

-

2020 Election: Joe Biden campaigned on a platform that included significant stimulus measures, particularly in response to the ongoing pandemic. His victory was followed by market anticipation of additional stimulus, particularly in sectors like green energy and healthcare.

Case Studies of Economic Stimulus and Elections

Obama Administration (2009-2017)

Barack Obama’s administration faced the challenge of addressing the aftermath of the 2008 financial crisis. The ARRA, passed in early 2009, was a key component of the administration’s efforts to revive the economy. The stimulus package focused on tax relief, state and local government aid, and infrastructure investment.

- Impact: The ARRA is credited with helping to stabilize the economy, though debates continue over its long-term effectiveness. Unemployment rates began to decline in the years following its implementation, and GDP growth resumed, albeit slowly.

Trump Administration (2017-2021)

The Trump administration’s approach to economic stimulus was characterized by the Tax Cuts and Jobs Act (TCJA) of 2017, which reduced corporate and individual tax rates. Additionally, the CARES Act in 2020 was a response to the economic fallout from the COVID-19 pandemic.

- Impact: The TCJA led to a short-term boost in economic growth, with increased business investment and consumer spending. The CARES Act provided essential relief during the pandemic, though it also significantly increased the federal deficit.

Economic and Market Implications

Stimulus and Economic Growth

Economic stimulus measures enacted after presidential elections can have a substantial impact on GDP growth. Government spending increases demand in the economy, while tax cuts can boost consumer spending and business investment.

Impact on Employment

Stimulus measures are often designed to create or preserve jobs, particularly during economic downturns. For example, infrastructure projects funded by stimulus packages can generate employment opportunities, while direct financial assistance can help sustain consumer demand, supporting jobs in various sectors.

Inflation and Interest Rates

Large-scale economic stimulus can lead to inflationary pressures, particularly if the economy is operating near full capacity. The Federal Reserve may respond to these pressures by adjusting interest rates, which can further influence economic conditions and financial markets.

Conclusion

U.S. presidential elections play a crucial role in shaping economic stimulus policies. The approach taken by the incoming administration can have far-reaching effects on economic growth, employment, inflation, and financial markets. Historical examples, such as the New Deal, the ARRA, and the CARES Act, demonstrate the significant impact of these policies on the U.S. economy. As such, the economic strategies proposed during presidential campaigns are closely watched by voters, investors, and policymakers alike.

References

- Federal Reserve Bank of St. Louis. “Fiscal Policy and Economic Stimulus.” Available at: St. Louis Fed Fiscal Policy

- Congressional Budget Office (CBO). “The Economic Impact of the American Recovery and Reinvestment Act.” Available at: CBO ARRA Report

- Brookings Institution. “The Long-Term Impact of the CARES Act.” Available at: Brookings CARES Act Analysis

- Harvard Business Review (HBR). “Economic Stimulus and U.S. Elections.” Available at: HBR Economic Stimulus and U.S. Elections